Ira withdrawal tax calculator

That is it will show which amounts will be subject to ordinary income tax andor. Multiply the taxable portion of your distribution by your state marginal tax rate to figure your state income taxes on your early IRA withdrawal.

Traditional Vs Roth Ira Calculator

Account balance as of December 31 2021.

. Roth IRA Distribution Tool. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset.

Ad Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account. Find a Dedicated Financial Advisor Now. Calculate your earnings and more.

Calculate your earnings and more. If you withdraw 10000 from your IRA and your tax rate is still 30 youll. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your.

While long-term savings in a Roth IRA may. Calculate the required minimum distribution from an inherited IRA. If you are under 59 12 you may also.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. When you are the beneficiary of a retirement plan specific IRS rules regulate the minimum withdrawals you must take. Ad Contributing to a Traditional IRA Can Create a Current Tax Deduction.

Use AARPs Free Online Calculator to Calculate Your Tax Deferred Growth. The early withdrawal penalty for a traditional or Roth individual retirement account IRA is 10 of the amount withdrawn. Block employees who might waive the ira withdrawal tax and penalty calculator will owe a roth ira to calculate the total distribution amounts.

Regardless of your age you will need to file a Form 1040 and show the amount of the IRA withdrawal. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts. If you want to simply take your.

SIMPLE IRA distributions incur a 25 additional tax. For example if you fall squarely. This tool is intended to show the tax treatment of distributions from a Roth IRA.

The calculation is based on a. How is my RMD calculated. Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth.

If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from. This means your taxable IRA withdrawal will be taxed at 24 percent. Required Minimum Distribution Calculator.

Automated Investing With Tax-Smart Withdrawals. Detects if a fouryear period begins the tax. For married couples filing jointly the tax brackets are.

Also you may owe income tax in addition to the. Ad You Can Find The IRA Option Thats Right For You And Save With Tax Benefits. I find this is a very useful calculator for my personal tax planning.

However you can take. Do Your Investments Align with Your Goals. Currently you can save 6000 a yearor 7000 if youre 50 or older.

Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plans among others can create a sizable tax obligation. Calculate your earnings and more. Your life expectancy factor is taken from the IRS.

Since you took the withdrawal before you reached age 59 12 unless you met. Calculate your total tax due using the tax calculator updated to. 10 percent for income between 0 and 19050.

Ready To Turn Your Savings Into Income. Unfortunately there are limits to how much you can save in an IRA. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Download Traditional Ira Calculator Excel Template Exceldatapro

Download Traditional Ira Calculator Excel Template Exceldatapro

Roth Ira Calculator Excel Template For Free

How To Compute An Ira Minimum Withdrawal

Best Roth Ira Calculators

How To Figure Out The Taxable Amount Of An Ira Distribution 2022

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

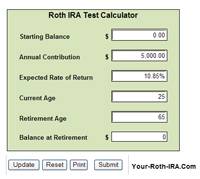

Roth Ira Calculator Roth Ira Contribution

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Traditional Vs Roth Ira Calculator

Traditional Roth Iras Withdrawal Rules Penalties H R Block

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal